Reserve studies in Florida play a critical role in the financial stability of condominium communities, particularly in the thriving areas of Palm Beach and Broward Counties. The integrity of shared assets directly impacts resident satisfaction, as well as the long-term sustainability of these communities. Amid rising property values and increasing demands for consistent maintenance, the importance of effective reserve studies cannot be overstated. These studies are vital tools for financial planning, ensuring communities have funds ready for necessary repairs and replacements over time.

A reserve study goes beyond budgeting; it serves as a strategic plan that assesses the current state of a community’s assets and projects future funding needs. Understanding the intricacies of these studies is invaluable for homeowners’ associations as they work to maintain financial health. Real-life examples illustrate how communities have successfully navigated the complexities of reserve studies, turning potential pitfalls into stepping stones for long-term stability.

This article examines successful reserve studies conducted in Palm Beach and Broward Counties, highlighting elements such as funding requirements, asset evaluations, and the comprehensive study process. By exploring specific case studies, readers can see how effective planning and proactive strategies enhance community resilience and sustainability.

What is a Reserve Study?

A reserve study is a crucial tool for the long-term financial planning of a condominium property or homeowner association in Fort Lauderdale, Florida. This comprehensive assessment evaluates the condition and the expected remaining useful life of the property’s major components, such as roofing, plumbing, and heating, ventilation, and air conditioning (HVAC) systems. A reserve study ensures that sufficient funds are available for future capital improvements and maintenance tasks, without placing an unexpected financial burden on the association members.

In Florida, particularly for buildings three stories or taller, reserve studies must be conducted by a qualified individual such as a licensed engineer, architect, or certified reserve specialist. These professionals provide an in-depth visual inspection as a part of the reserve study, which is vital for accurate assessment.

Given the dynamic nature of laws governing reserve requirements for condominium associations, associations must be adaptable to changes in legislation. A detailed facility assessment, which identifies both immediate and projected needs, is a cornerstone of a reserve study. Furthermore, associations that engage in a robust preventative maintenance program can increase the lifespan of crucial building components, resulting in reduced reserve funding needs in the long run.

Why Reserve Studies Matter for Communities

Reserve studies are a crucial tool for condominium associations and management companies in Fort Lauderdale, Florida. These detailed evaluations are pivotal in forecasting the future funding necessities for significant common elements like roofing and HVAC systems. The process ensures communities can plan budgets with foresight, instituting a robust preventative maintenance program. This not only helps in managing expenses but also in upholding property values.

Florida State law underscores the importance of professional reserve studies by mandating structures over three stories to commission such assessments from qualified firms, which may include licensed engineers or certified reserve specialists. Following Senate Bill 4-D, the Florida Department now requires Condominium and Cooperative Associations to carry out Structural Integrity Reserve Studies, further solidifying the necessity for these analyses to guarantee safety and adhere to regulations.

Seeking the right reserve study firm, familiar with Florida Department of State guidelines, is paramount. Their proficiency in understanding the unique real estate market dynamics and capital improvements requisite in areas like Fort Lauderdale can significantly affect the study’s utility, thus contributing to the community’s enduring prosperity.

Key Benefits of Reserve Studies for Communities:

- Proactive maintenance planning

- Financial forecasting for capital improvements

- Compliance with Florida State legislation

- Safeguarding resident safety

- Preserving and enhancing property values

Key Components of a Comprehensive Reserve Study

A comprehensive reserve study is a fundamental strategic tool for condominium associations in Fort Lauderdale, Florida. It encompasses a meticulous assessment of the condition and projected lifespan of all significant components within a building or community – from critical infrastructure systems like roofing, plumbing, and HVAC, to other pertinent components. By meticulously identifying both immediate and future capital expenditure needs, reserve studies ensure accurate fiscal planning for upcoming expenses.

Key to the reserve study’s validity is the experience and knowledge of the reserve study firm. These professionals delve into the property’s details to pinpoint essential repairs and previously executed projects that may impact the community’s financial well-being. For buildings that are three stories or taller, Florida statutes necessitate that a licensed engineer, architect, or certified reserve specialist carry out the visual inspection element of the reserve study.

In conjunction with these inspections, effective building management teams must engage in preventative maintenance programs. Such initiatives serve to extend the useful life of vital community features, thus attenuating future funding constraints and bolstering the overall health and sustainability of the property.

Funding Requirements

As per Florida State law, condominium associations must comply with stringent reserve funding guidelines. Especially significant is the prohibition against waiving or underfunding structural integrity reserve studies (SIRS), reinforcing the emphasis on maintaining full reserves for key building components. While certain flexibility is allowed regarding non-structural items—where associations may vote to wane or mitigate reserve funding—it is a balance to be strategically and carefully considered.

Calculating the remaining serviceable life and replacement costs for components included in a reserve study is critical. This calculation translates to a proposed annual reserve contribution sum that aims to evenly distribute the financial impact over time. Furthermore, new legislative changes necessitate a reevaluation of how existing reserve funds are allocated between SIRS and non-SIRS items for strict adherence to regulations. It is pertinent to note that overlooking milestone inspections or failing to complete SIRS represents a breach of fiduciary responsibility by the association’s directors or officers.

Asset Evaluation

A reserve study serves as a vital report that offers a discerning evaluation of the condition and expected utility span of a community’s major aspects. This rigorous scrutiny is imperative for adept asset management. Florida’s legislative framework obligates condominium associations to earmark funds for reserves that are directed towards capital expenditures and deferred maintenance, targeting items where replacement costs surge over the threshold of $10,000.

Assessing and setting reserves is an intricate process, which hinges on the remaining utility span and forecasted replacement outlays of reserve items. This approach ensures that contributions are commensurate with anticipated needs, thus safeguarding the association’s financial robustness. Senate Bill 4-D’s introduction fortifies this paradigm by mandating structural integrity reserve studies. For buildings exceeding a certain height, a licensed engineer or architect is mandatory for conducting visual inspections, guaranteeing a holistic assessment of asset condition.

Long-term Planning

When it comes to long-term planning, a reserve study is more than just a checklist; it’s a forward-looking strategy that articulates a schedule for repairs and replacements over an extended period, such as 30 years. This projection includes detailed cost estimates and a financial roadmap, designed to ensure the availability of funds when they’re needed most. Locking in a reserve study firm with specialized engineering expertise is invaluable for precise assessments of a community’s critical systems. This in-depth understanding lays the groundwork for informed, sagacious long-term financial strategizing.

Complying with Florida’s legal requisites, condominium associations must plan budget allocations for capital expenditures and deferred maintenance, specifically for notable costs that escalate beyond $10,000. It underlines the essence of proactive fiscal planning. A balance must be struck annually, with reserve studies reviewed and potential adjustments made to reserve contributions, helping to underpin effectual long-term management practices.

The Reserve Study Process

The reserve study process is a comprehensive assessment crucial for the financial planning and maintenance strategy of condominium and homeowners associations. At its core, it serves two fundamental purposes: helping to ensure that associations can competently address the repair and replacement of major components, such as roofing and HVAC systems, and to foster financial well-being for the long term.

Buildings three stories or taller require the expertise of reserve study firms with licensed engineers, licensed architects, or certified reserve specialists. These professionals perform visual inspections to evaluate the condition and estimated remaining lifespan of essential components. The Reserve Study process consists of both a Physical Reserve Analysis and a Funding Financial Analysis, each playing an integral part in deciphering an association’s financial needs.

Legislation in Florida evolves, often rapidly, potentially influencing reserve funding and maintenance approaches. Thus, it’s pivotal for associations to seek professional guidance to stay compliant with the latest statutes and best practices in reserve management.

Initial Assessment

The initial phase of a reserve study involves a thorough facility assessment, spearheaded by an experienced reserve study firm. This step is critical for pinpointing immediate and prospective needs, assessing safety, and energy efficiency within community associations. A comprehensive evaluation not only reveals critical repairs but also casts light on previous projects that might have been subpar.

A well-conducted initial assessment arms associations with various strategies to tackle essential projects. An effective reserve study guides associations in establishing a preventive maintenance schedule with a competent Management Company, which elongates the life span of costly elements and reduces funding requirements.

Data Collection

Data collection is the backbone of a reserve study. It focuses on accumulating detailed information about the condition and expected service lives of significant community components. This process must be thorough and precise, often involving a licensed engineer or a certified reserve specialist’s visual inspection to abide by the regulations.

According to Chapter 718 of the Florida Statutes, condominium associations are legally obliged to undertake a reserve study. Homeowners associations may only need to do so if their governing documents demand it. The methodology in calculating reserve funds is meticulous, hinging on the anticipated useful life and replacement costs of various components. Moreover, Senate Bill 4-D now stipulates that condominium and cooperative associations perform Structural Integrity Reserve Studies, underlining the importance of these evaluations.

Report Preparation

Preparation of reserve study reports is vital for illuminating the financial and maintenance requirements of condominium and HOA associations. These reports dive deep into budgetary analysis, essential for the safety and longevity of association buildings, while aligning with Florida’s legal standards.

Reserve study firms provide Property and Flood Valuation Reports specifically designed for condominium associations, which aid in satisfying insurance demands. These reports, including Structural Integrity Reserve Studies dictated by Florida Statutes, are designed to steward associations toward enhanced safety and functionality of the properties they oversee.

Implementation

The successful implementation of reserve studies culminates in establishing sound maintenance plans that facilitate the financial health of communities over time. These strategies aid associations in saving proactively for repairs and replacements, affirming long-term financial stability.

Proper implementation underscores the necessity of a consistent partnership with a seasoned reserve study firm to pinpoint immediate and future needs accurately. Moreover, Florida’s legal requirements for associations to conduct Structural Integrity Reserve Studies accentuate the significance of adhering to compliance.

Through the dual analysis of Physical Reserve Analysis and Funding Financial Analysis, reserve studies empower associations to apprehend their ongoing and approaching financial requisites thoroughly, allowing for astute planning and project execution.

Challenges in Conducting Reserve Studies

Conducting a reserve study in Fort Lauderdale, Florida can be a complex task for condominium associations, as it demands a forward-thinking approach and meticulous evaluation. One of the main challenges is the need to thoroughly anticipate both immediate and long-term needs through a comprehensive facility assessment. This task often requires an experienced reserve study firm that is both proficient in recognizing the criticality of repairs and adept at identifying previously poorly executed projects—factors that can significantly influence the reserve funding strategy.

Moreover, Florida statutes present additional challenges as they prohibit associations from waiving or only partially funding reserves specifically for structural integrity. This legislative requirement compels an uncompromising approach to financial planning, which sometimes strains an association’s ability to manage financial resources effectively. Furthermore, new legislation necessitates a reassessment of how existing reserve funds are segregated between structural and non-structural items, adding complexity to the compliance with updated regulations.

Lastly, there is a risk of legal repercussions if an association’s officers or directors fail to perform required inspections and reserve studies. This omission can be viewed as a breach of fiduciary duty, which heightens the stakes for proper adherence to the process and can lead to potential legal challenges for the association.

Common Pitfalls

The reserve study process is replete with potential pitfalls that condominium associations in Fort Lauderdale need to be cautious of. At the foundation of a reserve study is the comprehensive facility assessment, which if inadequately conducted, may miss crucial details regarding immediate and long-term needs of the property. Reliance on an experienced reserve study firm is key as it brings to light critical repairs and past inadequacies in project execution, which could substantially affect future funding and budgeting.

Despite the clear statutes in Florida, some associations may encounter difficulties with the non-waivable and partial funding of structural integrity reserves, although they retain the choice to vote for reduced funding for non-structural items. A critical pitfall to avoid is the failure to complete the mandatory milestone inspection and/or structural integrity reserve study. Such omissions can lead to a breach of fiduciary duty by the association’s officers or directors, entailing significant legal and financial ramifications.

It’s also imperative to accurately assess the remaining useful life and estimated replacement cost for each component within the condominium property. Neglecting these factors can result in an inaccurate reserve funding schedule, potentially leading to financial shortfalls or over-collection of fees from homeowners.

Legal and Regulatory Considerations

Florida’s new building safety laws place stringent legal and regulatory requirements on condominium and cooperative associations, particularly concerning the prohibition of waiving or reducing reserve requirements for structural components. This underlines the essential need for disciplined financial planning for maintenance and repairs and ensures that associations with buildings three stories or higher perform milestone building inspections.

Under Chapter 718 of the Florida Statutes, which deal with condominium associations, the mandate is to perform reserve studies. Conversely, Chapter 720, which governs homeowners’ associations, stipulates that reserve studies are not mandatory unless the governing documents of the association explicitly require them. In addition, the Florida Condominium Act insists that associations obtain an insurance appraisal every 36 months, though it stops short of mandating reserve studies.

A well-prepared reserve study is instrumental for boards to establish reserve schedules. To account for fluctuations in replacement costs and to reassess the assumptions about useful life, these schedules should be reviewed and updated annually, in keeping with best practices and in response to regulatory requirements. Doing so not only helps in maintaining compliance with Florida law but also fortifies the association’s financial health and preparedness for future repair and replacement needs.

Selecting a Qualified Reserve Study Firm

When tasked with the responsibility of maintaining a condominium property in Fort Lauderdale, Florida, it is essential to select a reserve study firm that can deliver comprehensive and compliant services. Due to the specific requirements set forth by Florida law, buildings three stories or taller must partner with a firm that employs a licensed engineer, architect, or a certified reserve specialist. This regulation ensures the visual inspection component of the reserve study meets professional and legal standards, ultimately protecting property values and supporting responsible capital improvements.

To assure the reserve study firm is up to scratch, it should not only be qualified and licensed but also adhere to the National Reserve Study Standards. Their work is more than just an inspection; it includes creating a meticulous schedule for the projected repairs and replacements of the common elements within the condominium association. This schedule comes complete with estimated costs and a detailed funding plan that enables the association’s board to allocate funds effectively over time.

Additionally, the rapid evolution of laws governing association reserves necessitates a reserve study firm that remains well-informed about legislative updates and market conditions. This knowledge base ensures that their guidance is accurate, and foresight prevents the association from facing unexpected costs. Hence, opting for a firm that is reputable can assist in maintaining the financial health of the association, curtail the need for imposing special assessments, and align with Florida State regulations and academic excellence in financial planning.

Credentials and Experience

Securing the services of a seasoned reserve study firm often necessitates partnering with one that can provide the appropriate licensed professionals. This is not only to conform to new legislative requirements regarding structural integrity but also to reassure the condominium association of the firm’s depth of competence. Management companies well versed in the field can often recommend reserve study firms that have a proven track record and extensive industry connections.

The vetting process for such firms includes interviews with firm representatives, during which their credentials and knowledge can be assessed. Preparation of pertinent questions before these interviews is crucial to gain an insight into the firm’s expertise. To aid in the evaluation, constructing a matrix of candidate firms and conducting thorough reference checks are vital steps. Any firm selected should be well-versed in providing detailed budgetary projections and useful life information for all relevant building components, according to market standards. This ensures that the association can rely on the reserve study for accurate and actionable financial planning for its condominium property.

Questions to Ask Potential Firms

When considering reserve study firms in Fort Lauderdale, Florida, for your condominium association or property, there are several questions that you should pose to potential candidates to determine their suitability for your needs.

- Years of Experience: Find out how long the firm has been in business. This can give you insight into their stability and experience in the industry, which is crucial for assessing condominium properties and planning for capital improvements.

- Annual Studies: Ask about the number of reserve studies they complete each year. This will help you understand their level of expertise and how effectively they manage their workload.

- Funding Strategies: Ensure the reserve study specialist employs both the straight-line method and the pooled method in their calculations. This provides a comprehensive view of possible funding strategies for your community.

- Community Experience: Inquire about the firm’s experience with properties similar to yours. This indicates their ability to cater to the unique needs of your condominium association, potentially impacting property values.

- Completion Time & Guarantees: Discuss the timeframe for completing the reserve study and any guarantees offered. This is important for planning purposes and to ensure that the firm is accountable for meeting deadlines.

By asking these questions, you’ll be better equipped to choose a reserve study firm that aligns with the specific needs of your Florida condominium property.

Cost-Benefit Analysis

Conducting reserve studies in Fort Lauderdale, Florida, is essential for condominium associations to maintain their structural integrity and safeguard property values. Florida statutes necessitate the implementation of Structural Integrity Reserve Studies (SIRS) for certain buildings. Such studies allow associations to understand the estimated remaining useful life and replacement costs of common elements, which are crucial for prudent financial planning and budgeting.

Engaging a reserve study firm on a multi-year agreement can offer substantial financial benefits as annual updates are made to accommodate cost increases, reducing the need for entirely new studies. This provides for more efficient and consistent management of financial resources. A well-prepared reserve funding schedule, outlined by a licensed engineer or reserve specialist, offers condominium associations in Florida a recommended annual reserve contribution. This approach is instrumental in steering toward financial stability and reducing the necessity for special assessments.

Due to Florida Department of State restrictions, associations cannot waive or only partially fund structural integrity reserves. This underscores the importance of a comprehensive reserve study conducted by competent firms in Fort Lauderdale to manage financial obligations adequately and ensure the longevity of the condominium property. A vigilant approach to financial management, embodied in up-to-date reserve studies, ultimately protects and enhances property values across communities in Florida.

Fiduciary Duties in Reserve Studies

Fiduciary Duties in Reserve Studies

In Fort Lauderdale, Florida, condominium associations are trusted with significant responsibilities, especially when it comes to the maintenance and safety of the property. The Florida Condominium Act emphasizes the importance of conducting a Structural Integrity Reserve Study (SIRS) and outlines strict fiduciary duties for Officers and Directors of the Association. Failure to complete a SIRS is recognized as a breach of fiduciary duty. Associations are required to maintain a record of the SIRS for a minimum of fifteen years, with easy availability of the most recent study for prospective unit purchasers.

Legislation, such as Senate Bill 4-D, underscores the critical nature of reserve studies, ensuring the safety and structural integrity of condominium properties. These reserve studies often influence board decisions relating to capital improvements and the deferred maintenance of common elements.

The association’s governing documents may additionally mandate the creation of reserve accounts for such expenses, further shaping fiduciary obligations. Board members must navigate these requirements carefully to uphold property values and maintain trust within the community. It is vital for associations to partner with qualified reserve study firms and professionals, preferably with credentials such as a licensed engineer or reserve specialist, to comply with Florida statutes and serve the condominium community effectively.

Business Judgment and Decision Making

Business Judgment and Decision Making

Effective decision-making is crucial for condominium associations, particularly when it comes to the long-term care and maintenance of the property. The role of management companies is pivotal as they guide boards in choosing qualified reserve study firms. Such firms perform comprehensive assessments to pinpoint immediate and future maintenance needs, leading to more strategic financial planning.

In Fort Lauderdale, condo boards must ensure their decisions comply with Florida’s legislative standards, including those reinforced by Senate Bill 4-D which institutes a structural safety program statewide. These decisions should also meet the “reasonable standards” set forth by Florida case law and align with the rules in the condominium declaration.

Implementing a robust preventative maintenance program is another strategic decision that a board can make. A management company can enact such programs, ultimately reducing the need for extensive future funding by addressing potential issues early. These strategic moves underline the importance of thoughtful judgment in maintaining and improving the condominium property, ensuring academic excellence in management practices, and safeguarding property values in the vibrant communities of Fort Lauderdale.

Key Factors in Strategic Condominium Management:

- Selection of qualified reserve study firms

- Compliance with legislation and case law

- Alignment with condominium declarations

- Establishment of preventative maintenance programs

Preventing Fraud in Associations

Preventing fraud within condominium associations and other housing communities is vital to maintain financial health and property values. Board members should be well-versed in their fiduciary duties and the Business Judgment Rule to make informed decisions, minimizing the potential for lawsuits. A clear understanding of the common reasons board members are sued can aid in creating preventative measures against fraud.

To safeguard the integrity of an association, it’s crucial to implement rigorous procedures to discover and prevent dishonest activities. This includes:

- Regular financial audits

- Strong internal controls

- Clear and transparent financial reporting

Directors and Officers (D&O) insurance provides an additional layer of protection for board members, mitigating risks associated with fraud and mismanagement. Furthermore, conducting comprehensive assessments, such as a Structural Integrity Reserve Study, is an effective strategy to uncover financial discrepancies early, acting as a deterrent against fraud.

By adhering to these practices, board members can not only avert fraudulent activities but also ensure proper governance and the long-term viability of their associations.

Impact of Florida’s New Building and Reserve Funding Regulations

In Florida, the landscape of condominium property maintenance and capital improvements has shifted significantly with the implementation of new building safety laws. These regulations have been enacted to enhance the safety of multi-story buildings and to ensure that appropriate funds are allocated for structural integrity.

Under the new laws, condominium and cooperative associations, especially those in areas like Fort Lauderdale, cannot waive or reduce reserve requirements pertaining to the structural integrity of their buildings. This emphasis on financial prudence aims to provide a robust safety net for essential structural repairs when they become necessary. As a result, buildings over three stories tall must now manage stringent milestone inspections and maintain dedicated reserve funds for structural maintenance and repairs.

The latest legislation requires associations to undertake a comprehensive reassessment of their reserve funds. There is now a clear delineation between funds allocated for structural integrity reserve study (SIRS) items (covering vital structural components) and non-SIRS reserve funds, which pertain to non-structural components. This segregation ensures that associations comply with the updated regulations, but it also may mandate an increase in reserve contributions from unit owners.

To streamline compliance with these changes, associations are mandated to establish a reserve funding schedule. This schedule must detail recommended annual reserve contributions to adequately cover the estimated costs associated with replacing or servicing each structural component identified in the SIRS. Failure to adhere to these regulations or to complete necessary milestone inspections and SIRS could result in willful non-compliance. For the officers and directors of an association in Florida, such non-compliance is considered a breach of fiduciary duty under the prevailing laws of the state.

Overall, the new building and reserve funding regulations serve to protect property values and ensure the long-term financial sustainability of condominium associations in Florida.

Milestone Inspections

To ensure the safety and compliance of condominium properties, Florida now requires milestone inspections for buildings with three stories or more. These milestone inspections are due by December 31 of the year a building turns 30 years old, with subsequent inspections every 10 years. If a building reached 30 years of age before July 1, 2022, the initial milestone inspection must be conducted no later than December 31, 2024.

These inspections are a critical aspect of maintaining structural safety and adherence to the states’ building safety laws. The core purpose of this mandate is to evaluate the building’s integrity and flag any issues that might require attention, ensuring the continued safety of residents.

For associations, it is crucial to ensure that the milestone inspections are thorough and compliant with the legal requirements. This not only safeguards the association from potential legal ramifications but also upholds the safety of the common elements shared by residents. Preventative maintenance derived from these inspections can also play a key role in maintaining and possibly enhancing property values as it demonstrates a commitment to building safety and longevity.

Structural Integrity Reserve Studies

Conducting Structural Integrity Reserve Studies (SIRS) has become a crucial requirement for Florida condominium associations, particularly in locales such as Fort Lauderdale. Following recent legislation, any condominium with three or more stories is mandated to complete a SIRS by December 31, 2024, if the association was established as of July 1, 2022.

A thorough SIRS includes a comprehensive visual inspection by a licensed engineer or architect, focusing on the reserve funds earmarked for substantial repairs and maintenance of common elements. Key components assessed typically encompass the roof, structural integrity, plumbing, and electrical systems, in addition to any items necessitating deferred maintenance costs over $10,000 which could compromise the building’s structural integrity.

Components Inspected in a SIRS:

- Roof

- Structural Integrity

- Plumbing

- Electrical Systems

- High-Cost Maintenance Items

Following the initial study, it is mandatory for associations to conduct SIRS at minimum intervals of every 10 years. These recurrent inspections are vital for maintaining safety and crafting a meticulous financial strategy for future needs.

The SIRS report concludes with a funding schedule that projects the recommended annual reserve contribution needed to cover the anticipated costs of replacements or maintenance for every item examined. This strategy is designed to shield property values and ensure that Florida State condominium properties are adequately maintained, aligning with the objectives of long-term capital improvements and fiscal responsibility.

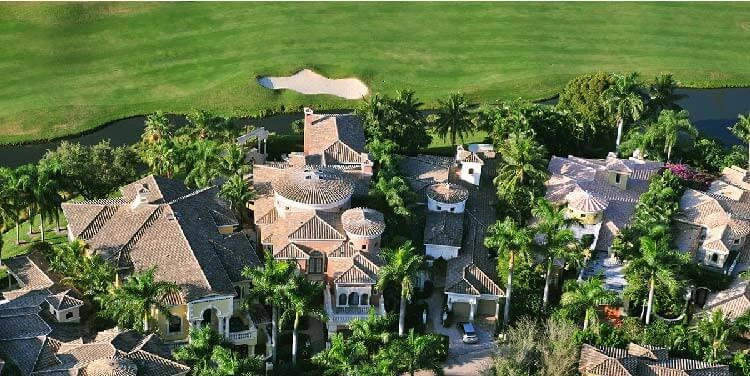

Successful Case Studies from Palm Beach County

The implementation of reserve studies has taken on unprecedented importance for the condominium and cooperative associations in Palm Beach County, Florida. With firms like Association Reserves, who have been dedicated to creating reserve studies since 1992, local associations have been able to secure comprehensive and user-friendly reports that account for local pricing and regional factors. These reports are particularly vital as they enable associations to make well-informed financial planning decisions.

The vigorous nature of Florida’s regulations, exemplified by the passage of Senate Bill 4-D, underscores an unyielding commitment to safety and the longevity of community properties. This bill has rendered Structural Integrity Reserve Studies (SIRS) compulsory, thereby underscoring the emphasis on successful case studies within the Palm Beach county area. Reserve studies are not just procedural; they are pivotal tools for ascertaining both current and future fiscal requirements for community associations.

By undertaking these detailed reserve studies, associations glean critical insights into their maintenance needs, which, in turn, boosts safety measures and helps to prevent prospective fiscal challenges. The value that these reserve studies bring to the table for Palm Beach County condominium and cooperative associations is immeasurable, ensuring that they can maintain and even enhance their properties to a superior standard.

Example 1: Community A

Community A in Palm Beach County exemplifies how essential it is for a condominium association to conduct a Structural Integrity Reserve Study, in alignment with the state’s response to the Surfside collapse—Senate Bill 4-D. Since 1992, Association Reserves has been at the forefront, developing such studies that not only meet state regulations but also adhere to National Reserve Study Standards.

These studies, armed with localized pricing knowledge, serve as the foundation for establishing a robust preventative maintenance program. This program aids associations in maximizing the lifespan of costly components, thereby reducing the need for further funding and cushioning financial plans for the future. Selecting a reserve study firm like Association Reserves, known for its wealth of experience and understanding of Southeast U.S. association needs, is paramount. Such a choice can significantly influence an association’s ability to pinpoint both immediate and long-term needs and sustain its financial well-being.

Example 2: Community B

Community B presents a scenario where the association confronted the reality of an insufficient reserve fund only after two decades during their inaugural reserve study. Rather than impose an immediate and substantial assessment increase on its residents, the board opted for a phased approach to increase the reserve assessments, thereby mitigating the impact on the community members.

The recent enforcement of Senate Bill 4-D further necessitates the need for such Structural Integrity Reserve Studies, ensuring that community buildings adhere to safety standards and regulatory compliance. These reserve studies, prepared with visual inspections by licensed professionals—like engineers or architects—investigate major building components for their condition and remaining useful life. Community B’s experience underscores the significance of regular and proactive reserve studies, both as a means of compliance and as a strategic tool for financial and safety planning—all the more pressing for buildings over three stories tall.

Successful Case Studies from Broward County

Since its inception in 1992, Association Reserves has been a trailblazer in delivering comprehensive Reserve Studies to community associations across Florida, particularly in Broward County. Their seasoned expertise reflects a nuanced understanding of the unique needs and challenges these communities face. Recognition for their outstanding service is evident, as they have been the recipients of the Florida Community Association Journal’s Readers’ Choice Award consistently from 2013 to 2022—a testament to their standing among local management companies and experts within the industry.

Association Reserves’ approach to Reserve Studies is meticulous. They factor in localized pricing and regional variables in Broward County, adhering to both Florida State requirements and National Reserve Study Standards. This meticulous approach ensures not only compliance but also success in the long-term fiscal health of community associations. Given Florida’s evolving building safety regulations, the role of Association Reserves has never been more critical. The state’s new legislation reinforces the necessity of regular inspections and the maintenance of robust reserve funds, making skilled reserve studies vital to the longevity of condominiums and cooperatives throughout the area.

J. R. Frazer Inc., another distinguished player in the reserve study sector, concurs on the need for thorough assessments. Their work in Broward County emphasizes the integral part these studies play in astute financial planning, safeguarding the sustainability of community associations. With Florida’s introduction of stringent laws for building safety, reserve studies are more than a financial formality; they are a linchpin in ensuring the structural integrity and fiscal solidity of properties.

Example 1: Community C

For Community C, a reserve study was not merely a legal requirement but a strategic move to guarantee the well-being of its shared infrastructure. Critical systems such as plumbing, roofing, and HVAC were meticulously analyzed to evaluate their current state and projected longevity. The initiation of this study began with an exhaustive facility assessment—a critical step for unearthing both immediate and longer-term maintenance needs.

Adhering to the stipulations of Senate Bill 4-D, Community C employed the expertise of licensed professionals like engineers or certified reserve specialists to carry out in-depth visual inspections. This approach is consistent with the legal mandate applied to communities with buildings of three stories or higher.

An outcome of this study was the realization of the importance of a proactive preventative maintenance program. Such a program is crucial for prolonging the life of significant communal components, which in turn reduces the potential for future financial strain on the association. Community C’s forward-looking strategy, informed by the reserve study’s findings, has placed them in a good position to manage their resources effectively and uphold both safety and property values within their condominium association.

Related Articles:

- Reserve Study Jacksonville Florida: Key Services for Community Financial Health

“Key reserve study services in Jacksonville, Florida, that support community financial health.” - Navigating the Waters of HOA Reserve Studies in Tampa, Florida

“Guidance on conducting HOA reserve studies in Tampa, Florida.” - Complete Guide to Palm Beach Shores Reserve Studies

“A complete guide to conducting reserve studies in Palm Beach Shores for community financial health.”